35+ are mortgage points tax deductible

Web Discount Points Deductions. You used the mortgage points to buy or build your main.

Image 003 Jpg

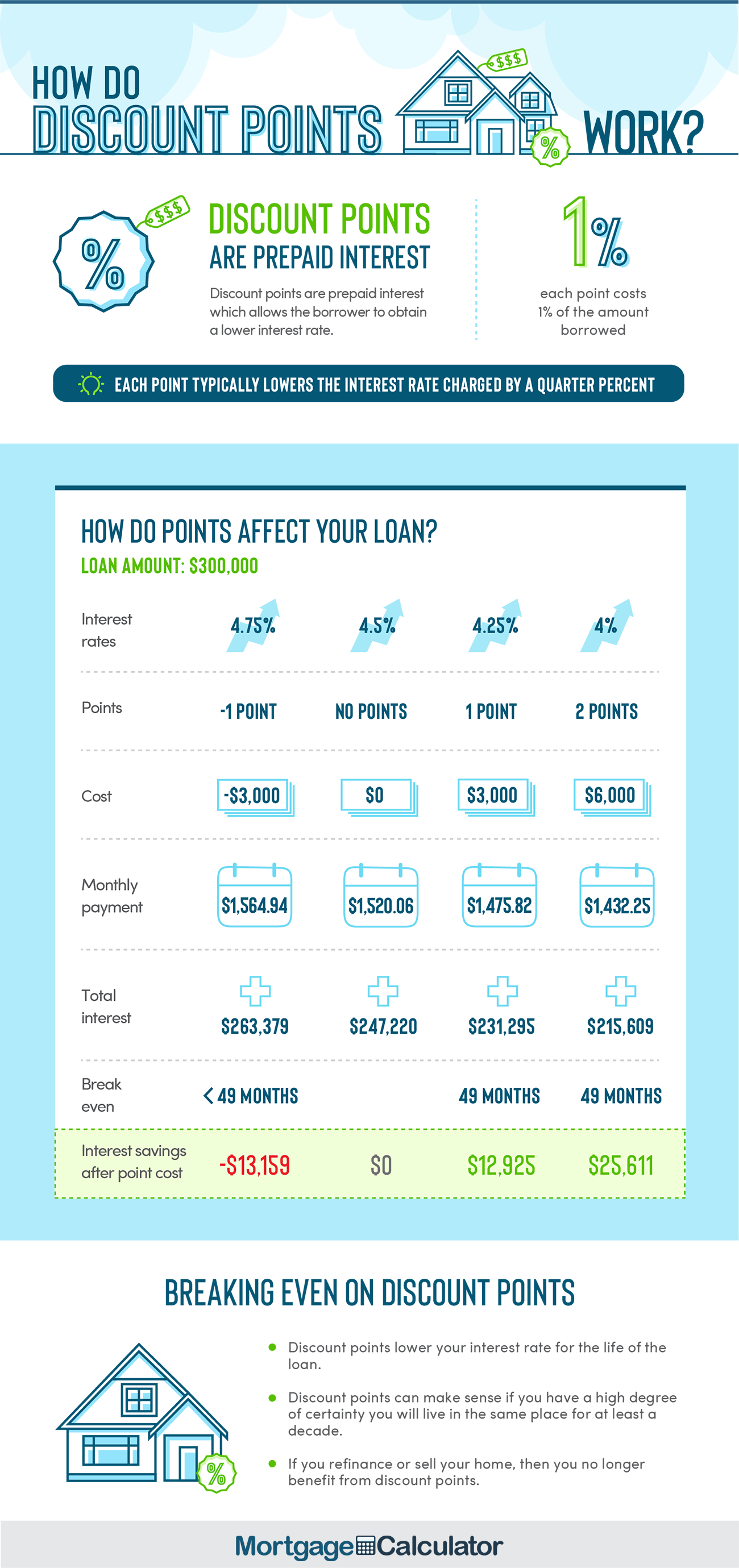

Web Mortgage points can be completely tax-deductible the year which you paid for them if you meet the right criteria.

. If you itemize your deductions on Schedule A of IRS Form 1040 you may be able to deduct. Web Have you heard of mortgage points. Web Mortgage points are considered prepaid interest and are tax deductible for the year you buy the house.

Theyre a way to reduce your interest rate by paying upfront when you get a home loan. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040. Youll only be able to deduct 75000 1 of 750000.

The amount you could deduct would be a little bit lower as. How to Deduct Mortgage Points on Your Taxes The IRS allows homeowners to deduct points as. Web If your loan is for home improvement or if you used refinanced mortgage proceeds to improve your primary residence you may fully deduct the points paid in the.

Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. Or else you might be at a position to deduct your mortgage. Web Yes you can deduct points for your main home if all of the following conditions apply.

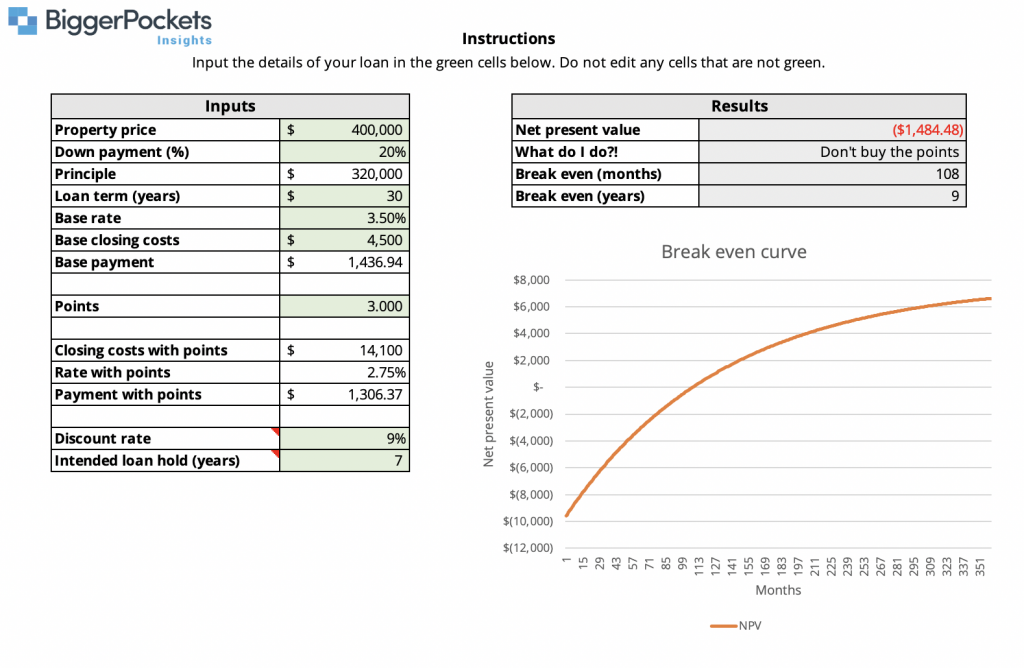

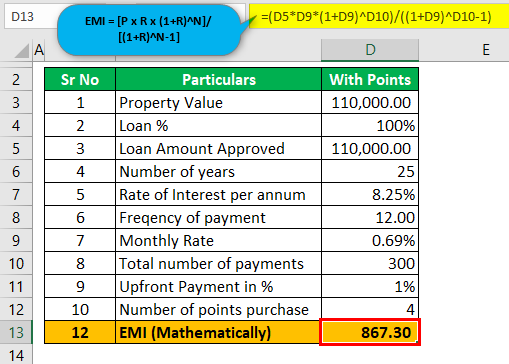

But are they tax deductible. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. To calculate the deductible points per year divide the total cost by the term in years of your mortgage.

Web Are Mortgage Points Tax Deductible. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. Web In this scenario you would not be able to deduct all 30000 of mortgage interest on your tax return.

Usually your lender will send you. Web Generally you cannot deduct the full amount of mortgage points in the year paid as they are considered prepaid interest and must be deducted equally through the. Web The deduction of mortgage points can reduce your taxes.

Here are the specifics. Web Since mortgage interest is deductible your points may be too. Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate.

Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. Youll need to itemize your deductions on Schedule A Form 1040 to. Web Up to 96 cash back You cant deduct mortgage points if the lender withheld the amount of the points from the loan proceeds.

The mortgage is used to buy build or improve the home and the. Web Up to 25 cash back Say you take out a 1000000 mortgage loan and purchase one point for 100000.

35 Best Must Have Wordpress Plugins For 2023 Free Paid

What Are Mortgage Points

What Are Mortgage Points And How Do They Work Ramsey

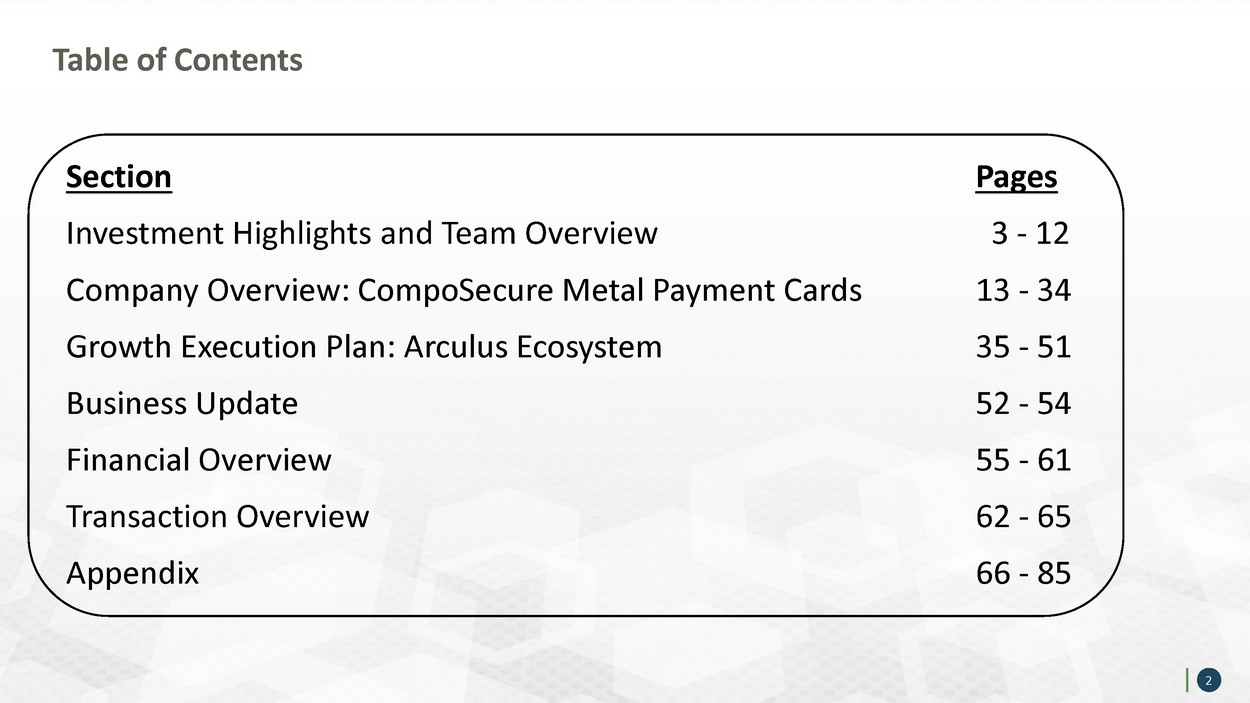

Should You Pay Mortgage Discount Points

Are Mortgage Points Tax Deductible

Discount Points Calculator How To Calculate Mortgage Points

Are Mortgage Points Worth The Cost

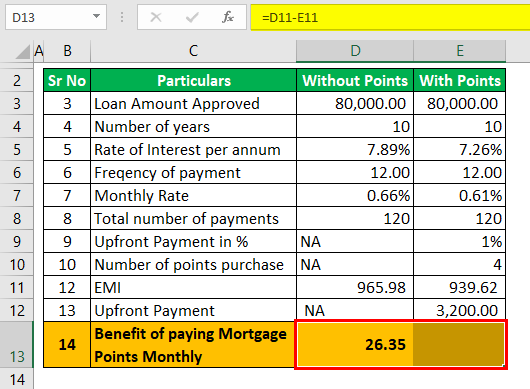

Mortgage Points Calculator Calculate Emi With Without Points

Free 35 Self Assessment Forms In Pdf

Ing International Survey Homes And Mortgages 2017 Rent Vs Own

How To Make Point Of Purchase Displays Cost 0 Rich Ltd

Jul 5 2012 Herald Union By Advantipro Gmbh Issuu

Mortgage Points Calculator Calculate Emi With Without Points

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Shopify Taxes 5 Must Know Deductions To Maximize Profits Reconvert

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos

Social Security United States Wikipedia